Under Construction at 22271 Broderick Drive in Ashburn

Posted in QTS Ashburn 1

Source: QTS

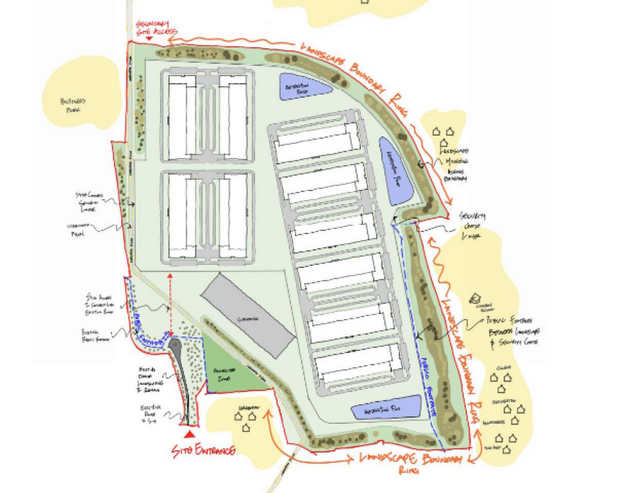

Site Plan Diagram of QTS's Ashburn 1 Site

Posted in QTS Ashburn 1

Source: QTS

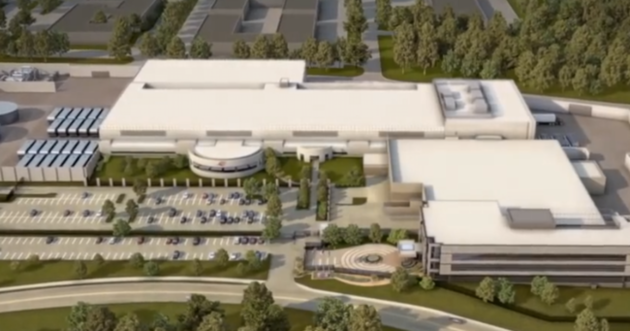

Aerial View of QTS's Ashburn Data Center

Posted in QTS Ashburn 1

|

Aerial Rendering of QTS's Irving Data Center

Posted in QTS Irving

Source: Walker Engineering

A Technician Rides a Bike Down a Data Center Aisle

Posted in QTS Atlanta Suwanee

Source: QTS

Flooring Structure Exposed During Renovation

Posted in QTS Irving

|

Front Door Entrance

Posted in QTS Irving

|

Pre-Construction Rendering of the Facility at 22271 Broderick Drive

Posted in QTS Ashburn 1

|

Aerial Rendering of QTS's Irving Data Center

Posted in QTS Irving

Source: QTS

Entrance to the QTS Atlanta Metro Facility

Posted in QTS Atlanta Metro

|

Cooling Tower on the Roof

Posted in QTS Atlanta Metro

Source: JE Dunn

Large Colocation Room

Posted in QTS Atlanta Metro

Source: JE Dunn

Gasketed Plate and Frame Heat Exchanger

Posted in QTS Atlanta Metro

|

Front of Building and Parking Area

Posted in QTS Atlanta Suwanee

|

Cooling Infrastructure

Posted in QTS Atlanta Suwanee

|

Colocation Room at QTS Suwanee

Posted in QTS Atlanta Suwanee

|

QTS's Site in Sandston (Richmond)

Posted in QTS Richmond I

|

QTS Sacramento at 1100 N Market Blvd

Posted in QTS Sacramento

Source: QTS

Outside of "The Vault"

Posted in QTS Ashburn-Moran

Source: QTS

Drone photo of the Ashburn-Moran facility

Posted in QTS Ashburn-Moran

Source: QTS

QTS data center at 95 Christopher Columbus Drive

Posted in QTS Jersey City

|

Drone shot of the facility on 9340 Godwin Drive

Posted in QTS Manassas DC1

|

The Manassas facility as construction was completing in February 2019

Posted in QTS Manassas DC1

|

QTS at 11234 NW 20th Street

Posted in QTS Miami

|

Overland is also the QTS headquarters

Posted in QTS Overland Park

|

Rendering of QTS Phoenix

Posted in QTS: Phoenix II Campus

Source: QTS

Mechanical Room

Posted in QTS: East Windsor 1

Source: QTS

QTS Princeton Solar Array is a 14.1 Megawatt Photovoltaic System

Posted in QTS: East Windsor 1

|

Front of the unassuming building

Posted in QTS: East Windsor 1

|

QTS at 2805/2807 Mission College Blvd

Posted in QTS Santa Clara

|

Conference Room

Posted in QTS Santa Clara

|

Mechanicals

Posted in QTS Santa Clara

|

Exterior of the Eemshaven facility

Posted in QTS Eemshaven

|

QTS at Zernikelaan 16, north of Groningen

Posted in QTS Groningen

|

Former Dupont Fabros Facility has Solar Array on the roof

Posted in QTS Piscataway

|

QTS expansion land called "Project Isaac" sits just South of QTS and West of the Facebook campus

Posted in QTS Richmond I

|

Rendering of QTS Hillsboro

Posted in QTS Hillsboro 1

|

Rendering of the 5 building campus

Posted in QTS: Phoenix II Campus

Source: QTS

Piscataway Facility

Posted in QTS Piscataway

Source: QTS

View of the almost completed facility in 2020

Posted in QTS: Phoenix II Campus

|

Posted in QTS: Chicago Campus

|

Rendering of facility

Posted in QTS: Denver Campus

|

Campus plan as of 2023

Posted in QTS Fayetteville

|

QTS Prince William Digital Gateway Campus context map

Posted in QTS: Prince William Digital Gateway Campus

|

The site of Hourigan's proposed campus at Richmond, Virginia

Posted in White Oak Technology Park 2

Source: Google Map

QTS acquired the planned Hermosa Ranch Tech Campus in Phoenix

Posted in QTS: Hermosa Ranch

Source: City of Avondale

QTS' Project Wind in Northumberland

Posted in QTS: Cambois Campus

Source: QTS

QTS' planned site at Mason Road in Dallas, Texas

Posted in QTS: DFW2-DC1

Source: Google Maps

Proposed site for SNA LLC's Cedar Rapids Campus

Posted in QTS: Cedar Rapids

Source: SNA LLC via Cedar Rapids City Council

QTS leased building B1 at New Century Commerce Center

Posted in QTS: New Century Commerce Center

Source: Van Trust Real Estate