Mar 30, 2021 | Posted by Eric Bell

DC BLOX has announced that they have secured $187 million for long-term financing of their operations. The funding was led by Post Road Group and Bain Capital Credit. Kevin O’Donnell, the Chief Financial Officer of DC BLOX, commented that the capital raised would support the growth of the Company’s existing facilities.

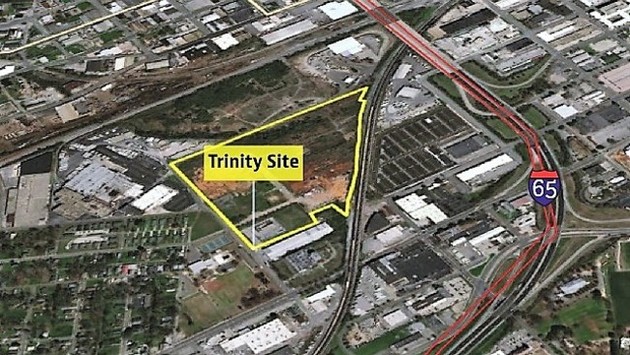

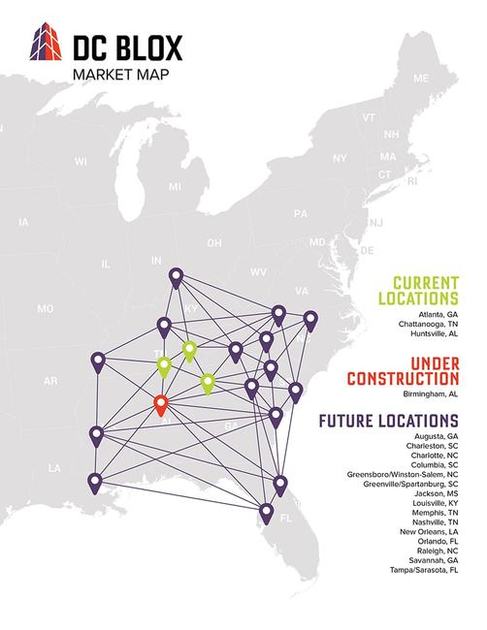

DC BLOX has Tier III-designed data centers in Atlanta, GA, Birmingham, AL, Chattanooga, TN, Huntsville, AL, and they will be opening one soon in Greenville, SC. Kevin O’Donnell further commented that the financing secured will be used to speed up the expansion of these Tier III-designed interconnected data center platforms.

DC BLOX Press Release on March 29th 2021:

DC BLOX Press Release on March 29th 2021:

Funding led by Post Road Group and Bain Capital Credit to accelerate DC BLOX’s enterprise and cloud data center deployments in new markets

ATLANTA – DC BLOX, a leading provider of interconnected multi-tenant data centers that deliver the infrastructure and connectivity essential to power today’s digital business, today announced that it has secured $187 million in long-term financing led by Post Road Group and Bain Capital Credit. Proceeds will be used to refinance DC BLOX’s existing credit facilities, add liquidity to DC BLOX’s balance sheet, and provide additional capital to fund continued investments in existing and new data center capacity.

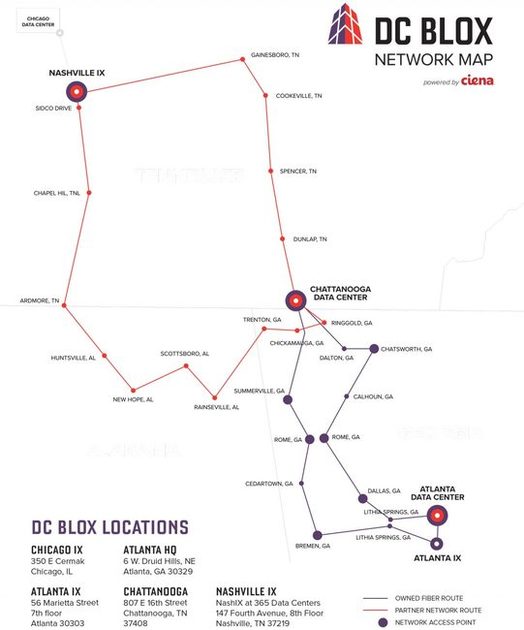

DC BLOX is among only a few data center operators who have received large investments to enable mid-market and Edge multi-tenant data center solutions. The Company builds new, Tier III-designed, state-of-the-art data centers fully connected by a high-speed, low-latency private network throughout the Southeastern United States. DC BLOX continues to stand out as a unique pure-play data center operator focused on underserved growing cities. The new funding illustrates resounding trust in its strategic vision and leadership team implementing the Company’s business plan to build and expand high-quality, multi-tenant data center facilities.

“This financing would have not been possible without the efforts of our team and represents a significant milestone for the company. The trust and partnership we have developed with the teams at Post Road Group and now with Bain Capital Credit are instrumental to our continued growth plans,” commented Jeff Uphues, CEO of DC BLOX. “This capital will be immediately deployed to support growth in our existing facilities and accelerate the expansion of our Tier III-designed interconnected data center platforms in other markets throughout the Southeastern United States,” said Kevin O’Donnell, Chief Financial Officer.

“Post Road Group is excited to be a major investor in DC BLOX. We’ve worked extensively with their world-class management team for the past four years and enthusiastically support their strategy to bring superior data centers, connectivity, and storage infrastructure to growing Edge markets,” commented Michael Bogdan, Managing Partner of Post Road Group.

“Edge computing, storage, and connectivity aggregation points are increasingly pushing outside of major metropolitan areas, and DC BLOX is well-positioned to capitalize on this expansion and deliver a state-of-the-art data center network to smaller markets. We look forward to the partnership with DC BLOX and to supporting the Company’s growth,” said Brian Hirschfeld, a Managing Director at Bain Capital Credit.

DC BLOX has Tier III-designed data centers located in Atlanta, GA, Birmingham, AL, Chattanooga, TN, Huntsville, AL, and opening soon in Greenville, SC. Each data center is interconnected through a private and redundant carrier-grade mesh-network ecosystem providing customers access to cloud on-ramps, Internet access, and an array of network options delivering both core and edge connectivity solutions.

Including this most recent round of financing, DC BLOX has secured more than $285 million since 2016 to accelerate and execute the Company’s growth strategy of bringing modern data centers, infrastructure, and connectivity to Edge markets. DH Capital served as financial advisor to DC BLOX and has served as a trusted advisor since 2018.

About DC BLOX

DC BLOX owns and operates interconnected multi-tenant data centers that deliver the infrastructure and connectivity essential to power today’s digital business. DC BLOX’s private network fabric and robust connectivity ecosystem enable access to built-in carriers, Internet exchanges, public cloud providers, and DC BLOX data centers to businesses across the Southeast. DC BLOX’s data centers are located in Atlanta, GA; Birmingham, AL; Huntsville, AL; Chattanooga, TN; and soon in Greenville, SC. For more information, please visit www.dcblox.com, call +1. 877.590.1684, and connect with DC BLOX on Twitter, LinkedIn, and Facebook.

About Post Road Group

Post Road Group (“Post Road” or “PRG”) is a private investment firm located in Stamford, Connecticut investing in corporate credit and real estate. Since its founding in 2015, Post Road Group has completed over $1 billion of investments. PRG’s Corporate Credit platform provides growth capital through senior secured loans and structured equity investments in the Technology, Media, Telecommunications (“TMT”), and business service industries, with a focus on telecom infrastructure and communications services in the lower-middle market, providing high-growth companies with flexible capital for strategic acquisitions, organic growth, and other special situations. The Firm’s Multifamily platform acquires and operates well-located multifamily properties nationwide, with a focus on attractive in-place cash flow and the ability to create value through repositioning. The Firm’s Real Estate Credit platform provides fast, flexible lending solutions to real estate owners, leveraging its extensive network and expertise to source investments that require flexible capital, need to close quickly, or are overlooked by banks and other traditional lenders. For more information about Post Road Group, please visit www.postroadgroup.com.

About Bain Capital Credit

Bain Capital Credit (www.baincapitalcredit.com) is a leading global credit specialist with approximately $44 billion in assets under management. Bain Capital Credit invests up and down the capital structure and across the spectrum of credit strategies, including leveraged loans, high-yield bonds, distressed debt, private lending, structured products, non-performing loans, and equities. Our team of more than 200 professionals creates value through rigorous, independent analysis of thousands of corporate issuers around the world. In addition to credit, Bain Capital invests across asset classes including private equity, public equity, and venture capital, and leverages the firm’s shared platform to capture opportunities in strategic areas of focus. Bain Capital Credit’s dedicated Private Credit Group focuses on providing complete financing solutions to businesses with EBITDA between $10 million and $150 million located in North America, Europe, and the Asia Pacific. Our dedicated global team affords us the ability to diligence the most complex situations and provide private capital to those companies.

About DH Capital

DH Capital is a private investment banking partnership serving companies in the Internet infrastructure, software & IT services, and communications sectors. Headquartered in New York City with offices in Boulder, Colorado, the firm’s principals have extensive experience and proven abilities in capital formation, finance, research, business development, and operations. DH Capital provides a full range of advisory services including mergers and acquisitions, private capital placements, financial restructuring, and operational consulting. Since its formation in 2001, DH Capital has completed 194 transactions and private capital placements totaling more than $32 billion in value.