STACK Ashburn Site Layout

Posted in STACK Northern Virginia

Source: Stack Infra

Artist Rendering of Infomart Ashburn

Posted in STACK Northern Virginia

Source: Infomart Data Centers

Infomart Ashburn Lobby

Posted in STACK Northern Virginia

Source: Infomart Data Centers

Digiplex Ulven

Posted in STACK OSL01 Ulven

|

Map of Nationwide Insurance Campus in Columbus

Posted in STACK New Albany NAL01

|

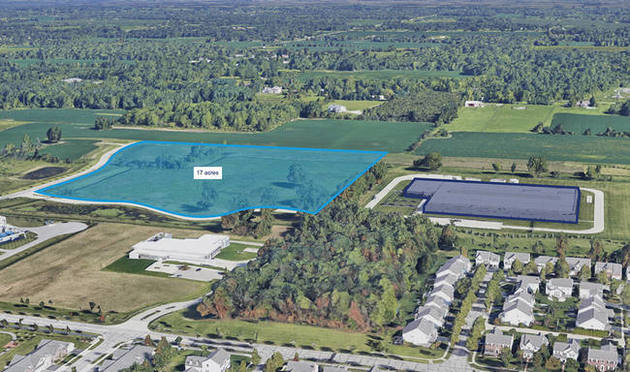

Aerial Photo of the Alliance Campus

Posted in STACK Fort Worth Alliance

Source: STACK

STACK Dallas Masterplan

Posted in STACK Fort Worth Alliance

Source: STACK

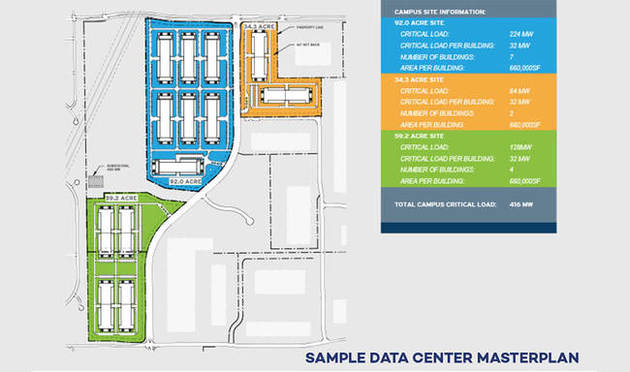

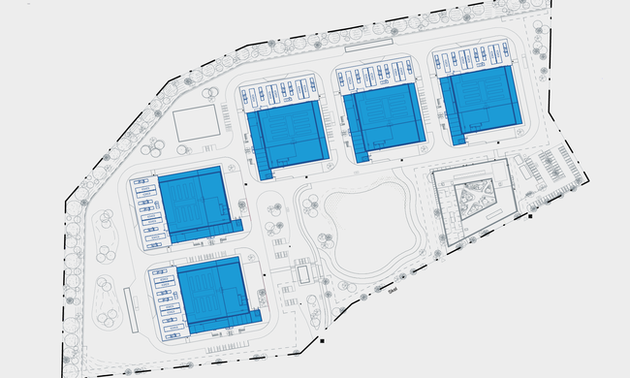

CHI01 Site Layout

Posted in STACK Chicago CHI01

Source: STACK

Rendering of the STACK expansion facility in Elk Grove

Posted in STACK Chicago CHI01

Source: STACK

Expansion area

Posted in STACK New Albany NAL01

|

Glass Facade of DigiPlex in Denmark

Posted in STACK COP01

|

Rendering of STACK's two story ATL2 facility

Posted in STACK Atlanta ATL02

Source: STACK

Digiplex DS1 in Upplands Vasby

Posted in STACK Stockholm STO01

|

Digiplex Rosenholm

Posted in STACK OSL02

|

Outside of the Fetsund facility

Posted in STACK OSL03 Campus

|

Fetsund II under construction in 2020

Posted in STACK OSL03B

|

Rendering of Fetsund II next to the existing facility

Posted in STACK OSL03 Campus

|

Drone photo of Hobol Facility

Posted in Stack OSL04

|

Generators

Posted in Stack OSL04

Source: Digiplex

The Lobby before the STACK rebrand

Posted in STACK Chicago CHI01

|

Customer Lounge area

Posted in STACK Chicago CHI01

|

Colocation Floor Area

Posted in STACK Chicago CHI01

|

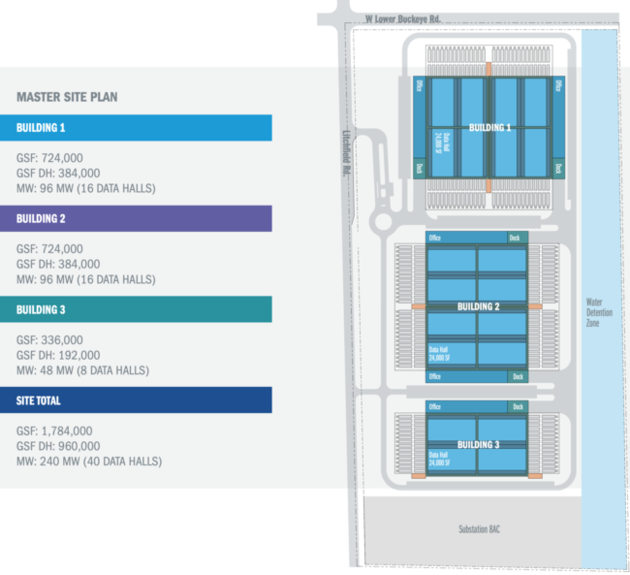

Master Campus Plan with 3 buildings

Posted in STACK Phoenix

Source: Stack

Rendering of the New SUPERNAP Italia

Posted in STACK Milan Campus

|

Rendering of the new STACK Toronto data center built at the old Eli Lily facility

Posted in STACK Toronto TOR01

Source: First Gulf

Rendering of SafeHost SH5 facility built in 2020

Posted in STACK: ZUR02 Beringen

|

Safe Host SH2

Posted in STACK Gland GEN02

|

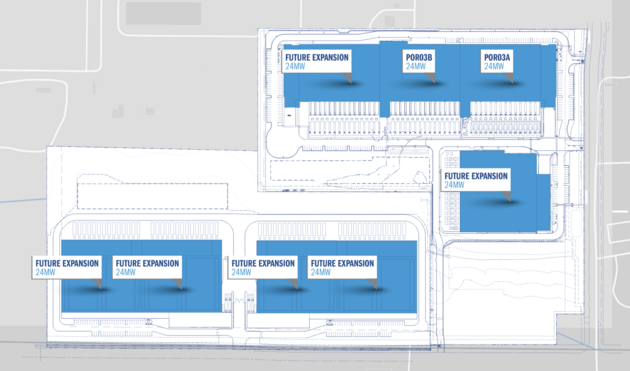

Site Floor Plan for POR03

Posted in STACK Portland POR03

|

Rendering of POR 03

Posted in STACK Portland POR03

|

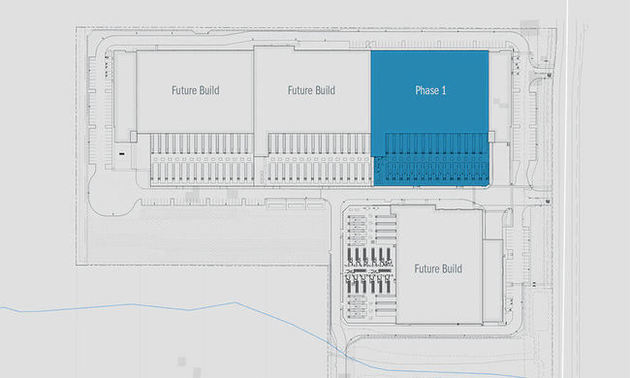

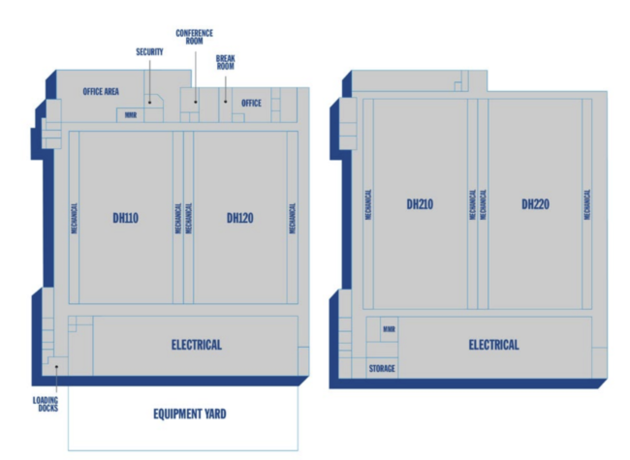

CHI02 floor layout

Posted in STACK CHI01B

Source: STACK Infrastructure

Rendering of SVY02

Posted in STACK SVY01B

|

Stack's Zurich facility

Posted in STACK ZUR01

|

Exterior Gland data center

Posted in STACK GEN01

|

COP02 campus layout

Posted in STACK Copenhagen COP02

Source: STACK

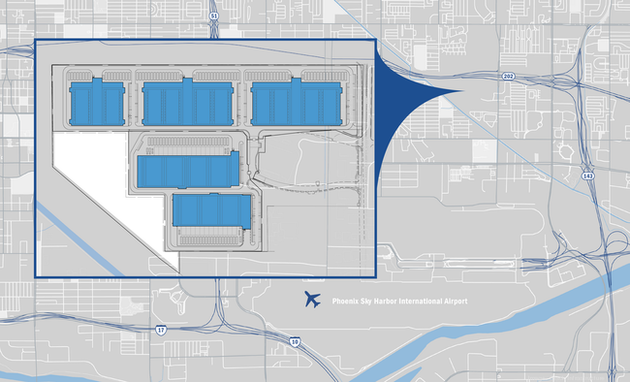

Campus layout for Stack Infrastructure's 5 building campus near Phoenix Sky Harbor International Airport

Posted in STACK Phoenix PHX02 Campus

Source: STACK Infrastructure

location of the Colt facility in Osaka

Posted in STACK Osaka KIX01

|

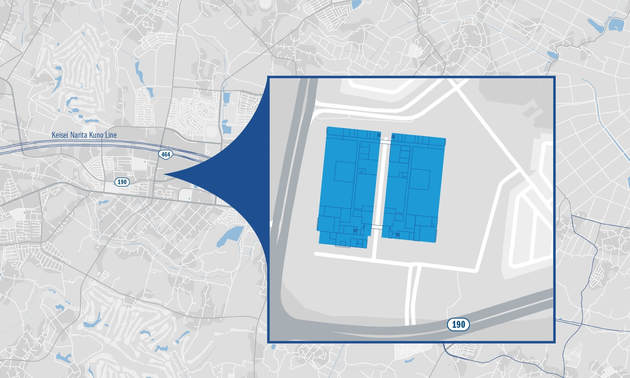

Location of STACK's 2 building campus

Posted in STACK TKY01

|

Campus Plan as of mid-2022

Posted in STACK Portland POR03

|

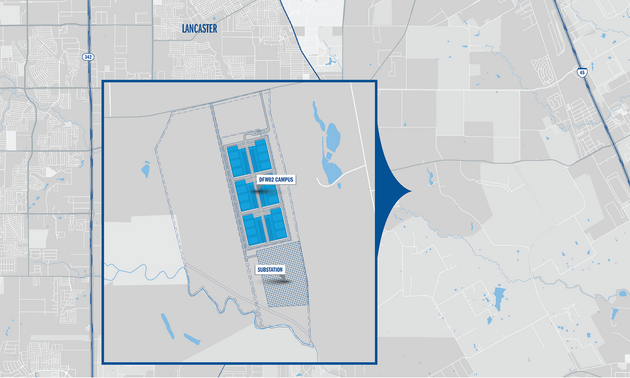

Stack DFW02 Campus Map

Posted in Stack: DFW02 Campus

Source: STACK Infrastructure

Stack Infrastructure ATL02 Sitemap

Posted in STACK Atlanta ATL02

Source: STACK Infrastructure

Stack Infrastructure ATL02 Sitemap

Posted in STACK: ATL02B

Source: STACK Infrastructure

Rendering of Stack Inrfastructure's OSLL4 Campus in Oslo

Posted in STACK OSLL4

Source: STACK Infrastructure

An aerial view of Stack Infrastructure's MIL01 Campus in Milan

Posted in Stack: MIL01B

Source: Schneider Electric Italia

Stack Infrastructure's MIL02A campus in milan

Posted in STACK: MIL02A

Source: STACK Infrastructure

Aerial view of Stack's MIL08 campus plot in Milan

Posted in Stack: MIL08

Source: STACK Infrastructure

Stack Infrastructure's STO01 Campus Sitemap

Posted in STACK: STO01B

Source: STACK Infrastructure

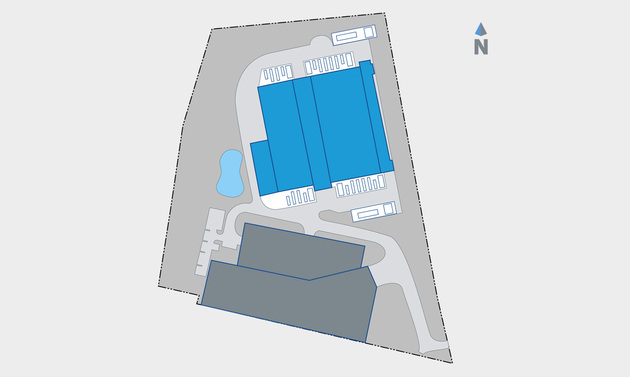

Stack Infrastructure's MEL01 Campus in Melbourne

Posted in STACK Melbourne MEL01

Source: STACK Infrastructure

Stack Infrastructure's MEL01 Campus in Melbourne

Posted in STACK Melbourne MEL01

Source: STACK Infrastructure

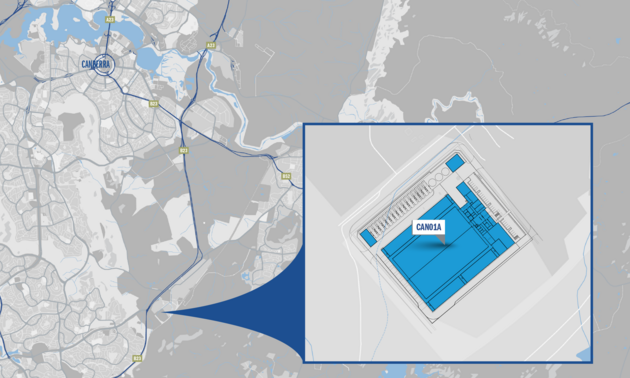

Stack Infrastructure's CAN01A Data Center Sitemap

Posted in Stack: Canberra

Source: STACK Infrastructure

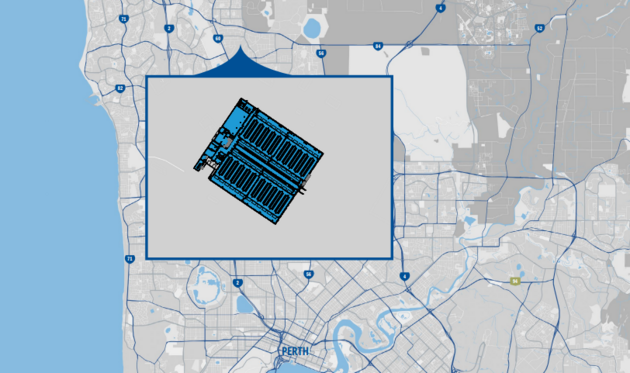

Stack Infrastructure's Perth PER01 Campus Sitemap

Posted in Stack: Perth PER01

Source: STACK Infrastructure

Rendering of Stack Infrastructure's Perth PER01 Campus

Posted in Stack: PER01B

Source: STACK Infrastructure

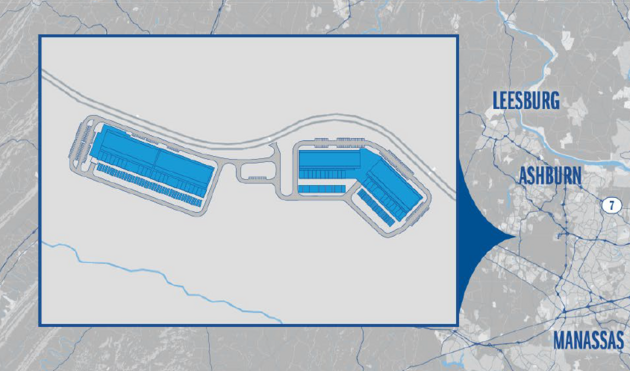

Stack Infrastructure's NVA06 Campus Sitemap

Posted in Stack: Northern Virginia, NVA06

Source: STACK Infrastructure

Stack Infrastructure's NVA06 Campus Sitemap

Posted in Stack: NVA06B

Source: STACK Infrastructure

Peterson Companies Stafford Tech Park in Virginia

Posted in Stack: Stafford Technology Campus (STC)

Source: Peterson Companies

Stack Infrastructure's Sitemap for Loudoun County Campus

Posted in Stack: Loudoun County Campus

Source: STACK Infrastructure

The site for Stack Infrastructure's Proposed Development in Fredericksburg, Virginia

Posted in Stack: Fredericksburg, VA

Source: Fredericksburg City Council

Rendering of Stack's FRAL1 data center in Frankfurt, Germany

Posted in STACK FRAL1

Source: STACK Infrastructure

Rendering of Stack Infrastructure's JHB01 Campus in Johor

Posted in Stack: Johor JHB01

Source: STACK Infrastructure

.jpg)

.jpg)