CyrusOne: CyrusOne Reports Q1 2019 Earnings: Revenue is $225M up 14% YoY

May 01, 2019 | Posted by Eric Bell

CyrusOne Inc. (CONE), a premier global data center REIT, today announced first quarter 2019 earnings.

First Quarter Highlights

- 1Q’19 Year-over-Year Revenue Growth of 14%

- Leased 16 megawatts (“MW”) and 93,000 colocation square feet (“CSF”) in the first quarter, totaling $27 million in annualized GAAP revenue

- Backlog of $39 million in annualized GAAP revenue as of the end of the first quarter

- As previously announced, acquired 22 acres of land in San Antonio and 8 acres of land in Santa Clara to support growth in those markets

- Estimated 120 MW of power capacity in San Antonio and nearly 200 MW of power capacity in Santa Clara (inclusive of previously acquired land)

- Strategically hedged EUR exposure, synthetically converting $270 million outstanding on the Company’s revolving credit facility into more attractively priced EUR-denominated debt (equivalent to €238 million), resulting in a nearly 300 basis point decrease in the interest rate

- Raised approximately $252 million in net proceeds through the sale of approximately 4.9 million shares of common stock under at-the-market (“ATM”) equity program

- As previously announced, subsequent to the end of the first quarter raised approximately $200 million through the sale of approximately 5.7 million American depository shares (“ADSs”) of GDS Holdings Limited (“GDS”)

- Increasing 2019 Normalized FFO per diluted share guidance2 by $0.20 at the midpoint of the range, from $3.10 - 3.20 to $3.30 - 3.40

“We are off to a great start to the year, with strong operational and financial performance, and leasing contributions across the portfolio as our international expansion creates an increasingly balanced and diversified business with a presence in the most important markets in the world,” said Gary Wojtaszek, president and chief executive officer of CyrusOne. “We continue to maintain a very strong balance sheet to support our growth, and recent initiatives have allowed us to significantly increase our Normalized FFO per share guidance while meeting our equity funding requirements for the year based on our current outlook.”

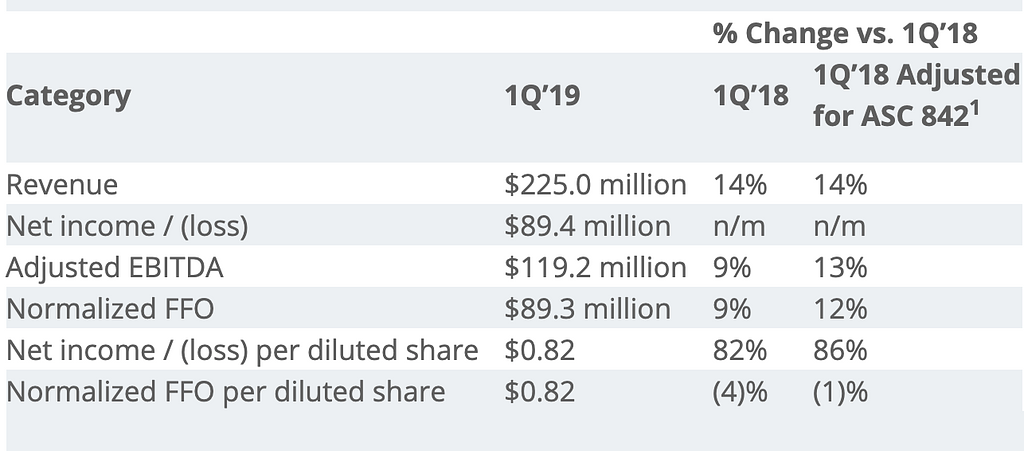

First Quarter 2019 Financial Results

Revenue was $225.0 million for the first quarter, compared to $196.6 million for the same period in 2018, an increase of 14%. The increase in revenue was driven primarily by a 22% increase in occupied CSF from organic growth and the Zenium acquisition, as well as additional interconnection services.

Net income was $89.4 million for the first quarter, compared to net income of $43.5 million in the same period in 2018. Net income for the first quarter included a $101.2 million unrealized gain on the Company’s equity investment in GDS, a leading data center provider in China, due to an increase in GDS’s share price during the quarter. Net income per diluted common share3 was $0.82 in the first quarter of 2019, compared to net income per diluted common share of $0.45 in the same period in 2018.

Net operating income (“NOI”)4 was $141.7 million for the first quarter, compared to $128.8 million in the same period in 2018, an increase of 10%. Adjusted EBITDA5 was $119.2 million for the first quarter, compared to $109.5 million in the same period in 2018, an increase of 9%.

Normalized Funds From Operations (“Normalized FFO”)6 was $89.3 million for the first quarter, compared to $82.2 million in the same period in 2018, an increase of 9%. Normalized FFO per diluted common share was $0.82 in the first quarter of 2019.

Leasing Activity

CyrusOne leased approximately 16 MW of power and 93,000 CSF in the first quarter, representing $2.3 million in monthly recurring rent, inclusive of the monthly impact of installation charges, or approximately $27.2 million in annualized GAAP revenue7, excluding estimates for pass-through power. The weighted average lease term of the new leases, based on square footage, is 56 months (4.7 years), and the weighted average remaining lease term of CyrusOne’s portfolio is 56 months (taking into account the impact of the backlog). Recurring rent churn8 for the first quarter was 2.1%, compared to 0.5% for the same period in 2018.

Portfolio Development and CSF Leased

In the first quarter, the Company completed construction on 249,000 CSF and 48 MW of power capacity across five projects in Northern Virginia, the New York Metro area, and Raleigh-Durham. CSF leased9 as of the end of the first quarter was 90% for stabilized properties10 and 86% overall. In addition, the Company has development projects underway in Northern Virginia, Dallas, the New York Metro area, Raleigh-Durham, Phoenix, Austin, Frankfurt, London, and Amsterdam that are expected to add approximately 190,000 CSF and 82 MW of power capacity.

Sale of GDS Shares

As previously announced, subsequent to the end of the first quarter the Company raised approximately $200 million through the sale of approximately 5.7 million ADSs of GDS. CyrusOne continues to hold approximately 2.3 million ADSs, valued at approximately $90 million based on the GDS closing price on April 30, 2019, with the remaining ADSs being subject to a six-month lock up period. The commercial agreement between CyrusOne and GDS remains in place, and Gary Wojtaszek remains a member of the GDS Board of Directors.

Balance Sheet and Liquidity

As of March 31, 2019, the Company had gross asset value11 totaling approximately $7.1 billion, an increase of approximately 32% over gross asset value as of March 31, 2018. CyrusOne had $2.92 billion of long-term debt12, $126.0 million of cash and cash equivalents, and $1.28 billion available under its unsecured revolving credit facility as of March 31, 2019. Net debt12 was $2.82 billion as of March 31, 2019, representing approximately 33% of the Company's total enterprise value as of March 31, 2019 of $8.6 billion.

0 Comments